CLIMATE FUNDS UPDATE

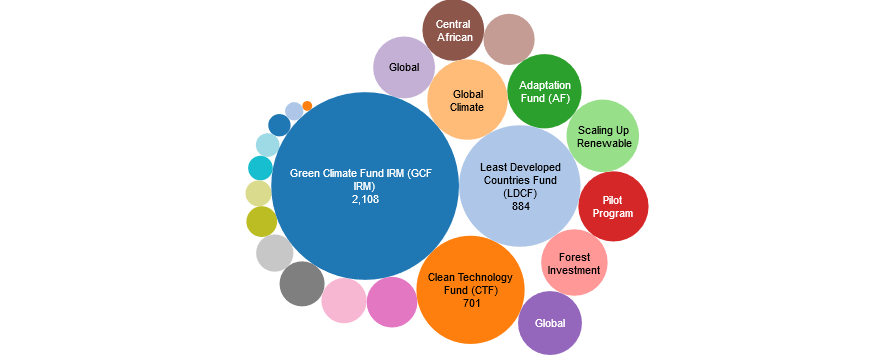

Climate Funds Update is an independent website that provides information and data on the growing number of multilateral climate finance initiatives designed to help developing countries address the challenges of climate change.

Multilateral climate funds play an important role in supporting countries to adopt low-emission, climate resilient development trajectories. They have a role in capacity building, research, piloting and demonstrating new approaches and technologies, and removing barriers to other climate finance flows.

The multilateral climate funds also hold critical political significance, reflecting an acknowledgement by developed countries for historical greenhouse gas emissions and in line with the commitments made by developed countries under the UNFCCC to support developing countries mitigate and adapt to climate change.